BOISE, ID – Eliminating federal clean energy tax credits would impact jobs and energy bills in Idaho, according to recent assessments of the budget reconciliation bill being considered by the U.S. Senate.

The credits, passed under the Inflation Reduction Act, have boosted more than 40 clean energy projects in Idaho.

An analysis from the think tank Energy Innovation claims the House version of the bill would lead to the loss of 7,900 jobs and increase energy bills by $420 by 2035 statewide.

Ryan McGoldrick, program director with Conservation Voters for Idaho, said that would only add to the financial woes Idahoans are already experiencing.

“It’s becoming increasingly unaffordable for Idahoans to stay and live in the state,” said McGoldrick, “and the clean energy tax credits is one of those clear ways that we can make an investment to keep our rates from skyrocketing. So, we hope to see that those get protected.”

Those against clean energy tax credits say they’re too expensive and give an unfair advantage to renewable energy.

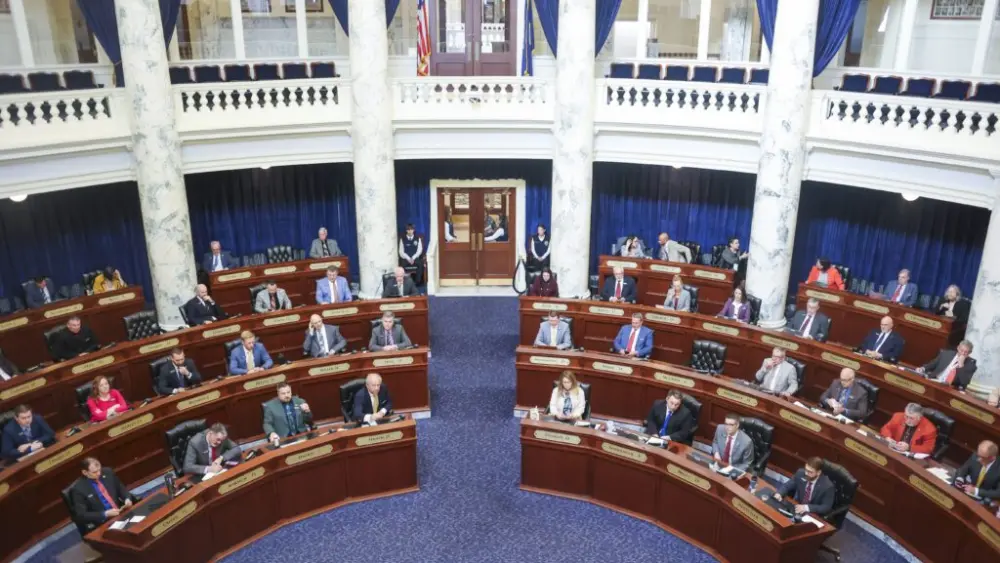

The House proposal has faced resistance in the Senate, including from U.S. Sen. Mike Crapo, R-ID, who said there should be a longer runway for the credits before they’re eliminated.

McGoldrick noted that renewable energy is important to Idaho’s energy landscape.

“We don’t have coal, we don’t have natural gas, we don’t have oil,” said McGoldrick. “We do have the opportunities for clean energy and renewable energy, and if we care about energy independence and we care about creating jobs in Idaho, it’s going to need to be in clean energy.”

Elizabeth Padian is a member of the Boise Open Space and Clean Water Advisory Committee. She said renewable infrastructure benefits everyone, especially as climate change results in more emergencies.

“We are in the midst of natural disasters that are becoming more frequent, more severe,” said Padian. “It is morally and financially the right choice to move towards a clean energy future.”