This story was originally posted on IdahoEdNews.org on June 17, 2025.

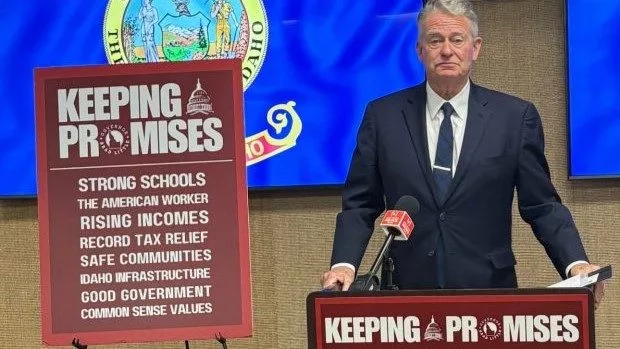

BOISE, ID – Idaho Gov. Brad Little’s office last month told state agency directors to make internal plans for budget “holdbacks,” midyear cuts in spending. Little also placed limits on budget requests.

The two directives come as state revenue lags behind projections and major tax cuts take effect.

Little’s Division of Financial Management on May 29 sent agency directors a memo outlining the governor’s expectations, as agencies prepare their budget requests ahead of next year’s legislative session.

The division issues similar guidance memos around this time every year. But the state is facing “a different scenario than we have seen in the past several years,” Division of Financial Management administrator Lori Wolff wrote in the latest memo, which Idaho Education News obtained through a public records request.

The Idaho Capital Sun reported last week that state tax revenue is $141.5 million below projections, while policymakers enacted $453 million in tax cuts this year. This means the state will have less revenue than projected in fiscal year 2027 and in future years, Wolff wrote in the memo.

Wolff told agency directors that budgets relying on state general fund dollars will be limited to “maintenance” spending. Directors must get pre-approval from the governor’s office before making new spending requests that use federal or dedicated funds. She also told directors to “internally prepare” for 2%, 4% or 6% budget holdbacks “as we continue to watch economic trends at the national evel.”

“Although we understand that there are still many initiatives and challenges that impact your agency and operations, we must submit a balanced budget,” Wolff wrote, “and Idaho’s current revenue projections only allow for slight growth in appropriations for FY 2027.”

Idaho Department of Education, State Board and higher ed will have to identify spending cuts

It’s too early to say what the budget restrictions could mean for public education funding. But the Idaho Department of Education, State Board of Education and colleges and universities will have to identify spending cuts up to 6%.

State revenue changes always impact education spending, whether tax collections are lower or higher than expected, state superintendent Debbie Critchfield said Monday.

“We are in budget discussions now and examining all types of scenarios,” she said.

In a statement to EdNews Tuesday, Wolff sought to ease concerns. The state is still seeing year-over-year revenue growth, “signaling a strong Idaho economy.” Lawmakers and Little left a $400 million cushion in the current year’s budget. They also put 22% of general fund revenues in rainy-day funds, Wolff said.

“That said, as a responsible manager of taxpayer resources, Gov. Little is preparing for a number of scenarios as we get closer to the end of the fiscal year. While we continue to watch revenue closely, we feel good about the strength of the state budget and our economy.”

Budget schedule

Agency directors must send the governor’s office their budget requests by Aug. 29.

These include spending requests for fiscal year 2027 as well as supplemental spending requests for fiscal year 2026.

- Fiscal year 2026 runs from July 1 to June 30, 2026. The Legislature set these budgets during the 2025 session.

- Fiscal year 2027 runs from July 1, 2026, to June 30, 2027. The Legislature will set these budgets during the 2026 session.

Little’s office will consider agency requests in the months leading up to next year’s session, and the governor will present his budget recommendations to lawmakers in January.

Why is state revenue lagging?

In her memo, Wolff noted two reasons for the “conservative” budget guidance: Lagging sales tax revenue and tax cuts.

In April, state tax revenue was $55 million short of the Legislature’s projection, and May revenues came in $98 million short, the Capital Sun reported last week.

Altogether, state revenue was $141.5 million below the Legislature’s projections heading into June, the last month of the 2025 fiscal year. The current shortfall would leave $278.2 million on the state’s ending balance for fiscal year 2025, down from $420 million.

Wolff told agency directors that Idaho is “seeing slower growth in sales tax revenue, so our revenue projections for future years have been adjusted downward. This will have a direct impact on budget planning for agencies (in the 2026 legislative) session.”

She also noted that the Legislature and Little this year made tax cuts worth $453 million. While this “historic tax relief” will eventually result in economic growth, she wrote, it means the state will collect less revenue than projected.

Lawmakers passed and Little signed these tax relief bills:

- House Bill 40 cut income taxes by $253 million by reducing the individual and corporate income tax rate from 5.695% to 5.3%, expanding exemptions for military pensions and eliminating capital gains taxes on gold bullion.

- House Bill 93 created a $50 million refundable tax credit program covering private school and home-school expenses.

- House Bill 231 increased the grocery tax credit to $155 per person, altogether providing $50 million in sales tax relief.

- House Bill 304 added $100 million to property tax relief funds that benefit homeowners and help school districts pay down bonds and levies.

These cuts were more than three times what Little proposed at the start of this year’s legislative session — he proposed in $100 million and $50 million for private school choice. While Little raised concerns about the scale of tax relief pitched by the Legislature’s Republican leadership, he has since touted the tax cuts in post-session appearances.

What does the budget guidance mean for public education?

The governor’s office on Tuesday did not address the likelihood of holdbacks in the coming months. But Wolff said that “public education and teacher pay will remain the governor’s top priorities.”

In her memo, Wolff wrote that planning for holdbacks “helps us be prepared for uncertainty” and “allows agencies to look internally at priorities and operations and ensure critical operations are prioritized.”

The Idaho Constitution directs the state government to maintain a balanced budget. And state law allows the governor to rescind spending authority if budgeted expenses exceed revenue in a given year.

Little last ordered budget holdbacks in 2020, during the COVID-19 pandemic, when he cut public school spending by 5%. Most of the cuts focused on discretionary and salary spending. Before that, former Gov. C.L. “Butch” Otter ordered holdbacks in 2010, following the Great Recession.

Critchfield said local school leaders are “paying close attention” to state revenues this month as districts and charter schools set their 2025-26 budgets. Some districts are facing budget strains already this year, after lawmakers and the Education department required minimum salary increases.

Looking ahead, schools’ operations costs and special education costs “won’t be going down,” Critchfield said, “so we are looking at ways to ease those pressures without new or ongoing dollars.”

The “maintenance” budget limitations essentially mean that agencies can only request funding for bills they have to pay — expenses that keep the lights on, satisfy contractual obligations and pay employees.

The Division of Financial Management sent out estimates of what these budgets should look like for most agencies. Colleges and universities, for instance, are limited to $398.1 million, and the Office of the State Board of Education can request up to $47.3 million. The Idaho Department of Education is not included in the list of estimates.

According to the memo, a maintenance budget includes:

- A 1% placeholder for state employee raises.

- An 18% increase in health insurance costs.

- Inflationary adjustments that are contractually obligated.

- Replacement item costs, calculated using a three-year average.

- Non-discretionary changes to population forecast adjustments.

If an agency plans to ask for a line-item “enhancement” from federal or dedicated funding sources, the agency must meet with the governor’s office “to discuss its necessity for inclusion,” Wolff wrote. Additionally, supplemental spending requests for FY 26 should be “used as a tool of last resort.”

The Division of Financial Management will later assess whether revenue projections support state employee raises — including for K-12 teachers — Wolff wrote. “Agencies should not submit line-item requests for additional personnel funds outside of” change in employee compensation, the state’s employee raise structure.

Click here to read Wolff’s full memo. And click here to see the maintenance budget estimates.

Idaho Capital Sun is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Idaho Capital Sun maintains editorial independence. Contact Editor Christina Lords for questions: info@idahocapitalsun.com.