This report has been updated.

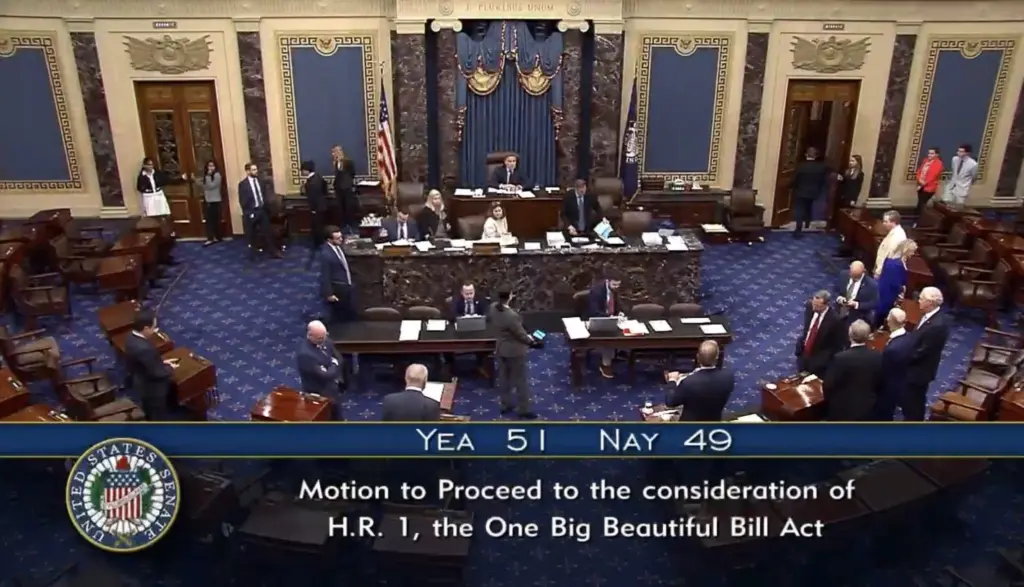

WASHINGTON, D.C. — The U.S. Senate voted mostly along party lines late Saturday night to move forward with Republicans’ “big, beautiful bill” that President Donald Trump wants on his desk in less than a week, after a dramatic three-hour pause when several GOP senators withheld their votes.

Republican Sens. Thom Tillis of North Carolina and Rand Paul of Kentucky voted against moving forward with the sweeping tax break and spending cuts package that contains many of the GOP’s campaign promises. All Democrats were opposed. Vice President JD Vance came to the Capitol in case a tie-breaking vote was required, but in the end was not needed.

Tillis, who is up for reelection in 2026, had told reporters earlier that he would vote “no” on what is called a motion to proceed and on final passage.

He said in a statement the legislation would result in tens of billions of dollars in lost funding for North Carolina and force the state to make “painful decisions” about Medicaid. Trump in a post on social media later threatened to find primary candidates to challenge Tillis.

The 51-49 vote doesn’t guarantee the bill will make it through a final passage vote but does make it significantly more likely, even with Republicans’ narrow 53-47 majority.

The procedural vote kicked off a maximum of 20 hours of floor debate on the bill, with half of that time controlled by Democrats and the other half by Republicans — though Democrats after the motion to proceed vote forced a reading of the giant bill expected to take as long as 15 hours. That would mean floor debate would not begin until sometime Sunday.

Unlike regular bills, budget reconciliation packages are not subject to the Senate’s 60-vote legislative filibuster, so as long as at least 50 Republicans support the package, and Vance casts the tie-breaking vote if needed, the measure will go back to the House.

The vote on the motion to proceed that began at about 7:30 p.m. Eastern was held open for more than three hours, with the votes of four senators in suspense — Lisa Murkowski of Alaska, Mike Lee of Utah, Cynthia Lummis of Wyoming and Rick Scott of Florida. All four eventually voted aye and Wisconsin Sen. Ron Johnson switched his vote to aye after earlier voting against the measure.

Lee, however, just before the vote was over, announced he had pulled from the bill an extremely controversial proposal to sell some public lands that was opposed by other lawmakers from the West. He said because of the process being used for the bill, he was unable to obtain enforceable safeguards to ensure the land would be sold to American families and not China or foreign interests.

The latest version of the measure had set up the Interior Department to sell at least 600,000 acres of public land and up to 1.2 million acres of public land within 10 years, advocates said.

Critics, including hunters, anglers and other Western state constituents, have ripped the measure as a “land grab,” as put by Jennifer Rokala, executive director for the Center for Western Priorities.

A summary of the provisions by the Energy and Natural Resources Committee said the Bureau of Land Management “must sell a minimum of 0.25% and a maximum of 0.50% of their estate for housing and associated community needs. This will increase the supply of housing and decrease housing costs for millions of American families.”

Golfing with Trump

Senate GOP leaders released new bill text just before midnight Friday that satisfied rural state lawmakers’ worries about financial threats to rural hospitals posed by cuts in Medicaid. The bill also addresses concerns by Murkowski and Dan Sullivan of Alaska about access to food assistance for their constituents despite new restrictions on a USDA program for low-income people.

As talks continued on Capitol Hill Saturday afternoon, a handful of Senate Republicans, including Missouri’s Eric Schmitt and Lindsey Graham of South Carolina, were on the golf course with Trump, according to the White House. Graham said on social media that Kentucky’s Paul also played.

Senate Democrats said a fresh financial analysis from the nonpartisan Congressional Budget Office estimated the preliminary Senate text would result in $930 billion in cuts to Medicaid, the joint federal-state low-income health insurance and disability assistance program.

The CBO score was not yet publicly available but Sen. Ron Wyden, the top Democrat on the Senate Committee on Finance, pointed to it and slammed the Medicaid provisions as “cruel” in a statement Saturday afternoon.

Sen. Elizabeth Warren of Massachusetts, ranking Democrat on the Senate Banking, Housing, and Urban Affairs Committee, also cited the preliminary analysis, pointing to the nearly $1 trillion in Medicaid cuts.

Collins promises amendments

Senate Republicans planned to take their negotiations to the floor and push for amendments after the procedural vote that triggered official debate on the bill, which in its current public version runs 940 pages.

GOP Sen. Susan Collins of Maine, who voiced concerns throughout negotiations about rural hospitals and health cuts that would harm low-income individuals, said her vote on the motion to proceed “does not predict my vote on final passage.”

“I will be filing a number of amendments,” she told reporters as she headed into a closed-door working lunch before the Senate convened at 2 p.m. Eastern.

While Sen. Tim Sheehy wrote on social media Saturday afternoon that he was a “no” on the motion to proceed because of a provision to sell off federal public lands, the Montana Republican changed his mind nearly an hour later and declared he would propose an amendment to strip the provision — which was later removed by its sponsor.

GOP Sen. Markwayne Mullin of Oklahoma painted somewhat of a rosier picture of the mood in the Senate, telling reporters “we’re good.”

“We won’t bring it to the floor if we don’t have the votes,” said Mullin, who was the lead negotiator with House Republicans on state and local tax deductions, or SALT — a sticking point for Republicans who represent high-tax blue states like New York and California.

The lawmakers settled on a $40,000 deduction through 2029 for taxpayers who earn up to $500,000 annually. The level then reverts to $10,000, the current limit under the 2017 tax law.

Medicaid turmoil

Proposed changes to Medicaid have been strongly resisted by rural medical providers who say they are already financially strapped.

Missouri Republican Sen. Josh Hawley told reporters Saturday he would be a “yes” on both the motion to proceed vote and the final bill based on the new rural hospital “transformation program” Senate leadership included in the bill overnight. The measure has yet to be finalized.

The bill’s new version includes $25 billion in a stabilization fund for rural hospitals from 2028 through 2032. The amount is frontloaded to give more of the funds in the first two years.

Critics warn that amount will not fill the financial gaps that rural medical providers will face from losing a sizable portion of federal funding via Medicaid cuts.

While Hawley called the fund a “win” for Missouri over the next several years, he said his party needs to do some “soul searching” over the “unhappy episode” of wrangling over Medicaid cuts.

“If you want to be a working-class party, you’ve got to deliver for working-class people. You cannot take away health care for working people,” he said.

Senators had not yet agreed on other Medicaid provisions as of Saturday afternoon, including a phase-down of the provider tax rate from 6% to a possible 3.5% that’s become hugely controversial.

States use a combination of general revenues, provider tax revenues and in some cases local contributions to fund their Medicaid programs.

Advocates warn that it’s not a guarantee states would be able to backfill the lost revenue, and if they can’t, provider rate cuts and losses of benefits for patients could be on the horizon.

The nonpartisan Congressional Budget Office found that the House version’s provider tax changes — not as deep as the current Senate proposal — could lead to 400,000 people losing Medicaid benefits.

A full and final financial score for the Senate bill is not yet out as the several provisions remain up in the air.

Hawley also praised the inclusion of the Radiation Exposure Compensation Act fund, or RECA, that revives payments for survivors and victims who suffered cancer as a result of U.S. atomic bomb testing and radioactive waste dumps.

Clean energy tax credits

In what clean power advocates dubbed a “midnight dumping,” Senate GOP leadership added language to accelerate the phase out of clean energy tax credits that were enacted under Democrats’ own massive mega-bill in 2022 titled the “Inflation Reduction Act.”

The language, which wasn’t yet finalized by Senate GOP tax writers as of 6 p.m. Eastern Saturday, tightened restrictions on foreign components in wind and solar projects — and added a new tax on those that don’t comply.

Senators largely targeted wind and solar credits, ending them for projects not plugged into the electricity grid by 2028. Additionally credits for wind turbine manufacturers would terminate in 2028.

Other tax credits would be phased out at a faster pace, including those for the production of critical minerals, though a credit for metallurgical coal, used in steelmaking, was added in.

Clean energy industry manufacturers and small businesses had hoped Senate Republicans would ease up rollbacks in the House version.

Kurt Neutgens, president and chief technology officer of Orange EV, told States Newsroom in an interview Friday that any further rollbacks would amount to “cutting our legs out from underneath us.”

Neutgens, whose Kansas City, Kansas-based company manufactures heavy duty electric trucks and chargers, was watching for changes to credits to the commercial clean vehicles credit. New Senate GOP text would terminate the credit in September of this year.

Jason Grumet, president of the Clean Power Association, said in a statement Saturday that imposing new taxes on the industry “will strand hundreds of billions of dollars in current investments, threaten energy security, and undermine growth in domestic manufacturing and land hardest on rural communities who would have been the greatest beneficiaries of clean energy investment.”

Alaska carve-outs

Proposed cuts to federal food assistance remained largely unchanged in the new text released Friday night except for a few carve-outs for Alaska.

If the bill were enacted as written, Alaska’s state government could request a waiver for its citizens from stricter work reporting requirements that critics say will result in some SNAP recipients losing their food benefits.

GOP lawmakers also slightly shifted the timeline for when states will have to begin shouldering SNAP costs — the first time states will be on the hook for the federal food assistance outside of administrative costs.

States would be required to pick up a portion of the costs depending on their “payment error rate” — meaning how accurate states are at determining who needs SNAP, including both overpayments and underpayments.

States that have error rates at 6% or above would responsible for up to 15% of the food program’s cost. According to SNAP error rate data for 2023, the latest available, only seven states had an error rate below 6%.

The new text delays the cost-sharing for states until 2028 and allows states to choose the lesser of their two error rates in either 2025 or 2026.

Starting in 2029, states will be required to use their error rate from three years prior to the current year.

The new text includes the option for Alaska and Hawaii to waive their cost share burden for up to two years if their governments implement an improvement plan. In 2023, Alaska had the highest payment error rate of all states, reaching just above 60%.

Advocates for low-income families worry the cost, which will amount to billions for most state governments, will incentivize states to tighten eligibility requirements for the program, or even drop SNAP altogether.

The left-leaning Center on Budget and Policy Priorities estimates the cuts will affect up to 40 million people who receive basic SNAP assistance, including 16 million children and 8 million seniors.

The Senate bill would also increase a state’s share of administrative costs for the program to 75%, up from the previous 50% cost-sharing responsibility with the federal government.

Despite inaccurate public statements from Republicans as recently as in a bill summary released overnight, the bill does nothing to limit food assistance to immigrants without documentation because SNAP was never available to them.

SNAP benefits will remain available to legal permanent residents, and Republicans loosened some language to allow certain immigrants from Cuba or Haiti to access the program.

But if the bill passes, federal food assistance will not be available to refugees and asylees who are already in the U.S. — for example, people from Afghanistan, Ukraine and other war-torn places.

Education revisions

Republicans on the Senate Committee on Health, Education, Labor and Pensions revised or scrapped several measures that the parliamentarian deemed to not comply with the “Byrd Bath,” a Senate process named for the late Sen. Robert Byrd, according to a summary and new bill text out Friday.

Under the revised text, for any loans made starting July 1, 2026, borrowers will have only two repayment plan options: a standard repayment plan and an income-driven repayment plan. The original proposal would have applied these restrictions to existing borrowers, but the parliamentarian struck that down.

Republicans also nixed a proposal that opened up the Pell Grant — a government subsidy that helps low-income students pay for college — to institutions that are not accredited.

The new plan also scraps a restriction that barred payments made by students enrolled in a medical or dental internship or residency program from counting toward Public Service Loan Forgiveness.

‘Even worse than any draft’

Senate Democrats remain united in opposition to the bill and are expected to slow down final passage by introducing numerous amendments on the floor during what is called the vote-a-rama.

Senate Minority Leader Chuck Schumer continued to rally against the package during remarks on the Senate floor Saturday afternoon, saying it’s “hard to believe this bill is worse — even worse — than any draft we’ve seen this far.”

The New York Democrat said “it’s worse on health care, it’s worse on SNAP (the Supplemental Nutrition Assistance Program), it’s worse on the deficit.”

Schumer added that “if Republicans proceed, Senate Democrats will hold them to account.”

“We’ll gear up for another night of vote-a-rama very soon. We’ll expose this bill piece by piece. We will show how it cuts health care, raises costs, rewards the ultra rich.”

The Center on Budget and Policy Priorities condemned the cuts to safety net programs as “all in service to tax cuts that are heavily skewed toward the wealthy and corporations.”

“None of this harm has anything to do with fiscal responsibility: our deficits and debts would soar under this bill,” said Sharon Parrott, the think tank’s president, in a statement Saturday.

The Committee for a Responsible Federal Budget, a nonpartisan watchdog, released a new analysis Saturday finding the Senate version will add roughly $4 trillion to the national deficit over 10 years.

“If you thought the House bill borrowed too much — and it did — the Senate manages to make things even worse,” CRFB’s president Maya MacGuineas said in a statement.

House action

Senate Republicans have spent more than a month rewriting the bills that make up the measure in order to meet the strict rules for moving a budget reconciliation package and to earn support from enough Republicans to actually pass the legislation.

The lawmakers have been struggling to maintain spending cuts passed by House Republicans that will pay for the nearly $4 trillion price tag for extending and expanding the 2017 tax cuts.

The House voted 215-214 to approve its 11-bill version of the package in May. Many of that chamber’s GOP lawmakers hoped the Senate wouldn’t change much, though that hasn’t been the case.

The Senate has modified numerous proposals, including those addressing tax law; Medicaid; and SNAP. The Senate bill also raises the country’s debt limit by $5 trillion, a full $1 trillion more than the House version.

The revisions have led to concerns among both centrist House GOP lawmakers and far-right members of the party, muddying the waters around whether Speaker Mike Johnson, R-La., can cobble together the votes needed to clear the package for Trump’s signature.

Republicans hold a 220-212 majority in the House, so leaders there can only lose four members if all of the chamber’s lawmakers are present and voting.

Trump has encouraged Congress to approve the legislation before the Fourth of July, but with time running short and some tempers rising over how the legislation will impact the country’s deficits, that might not be possible.

“The Great Republicans in the U.S. Senate are working all weekend to finish our ‘ONE, BIG, BEAUTIFUL BILL’,” Trump posted on social media Friday.

“The House of Representatives must be ready to send it to my desk before July 4th — We can get it done,” he added. “It will be a wonderful Celebration for our Country, which is right now, ‘The Hottest Country anywhere in the World’ — And to think, just last year, we were a laughingstock. Thank you for your attention to this matter!”

Last updated 8:09 a.m., Jun. 29, 2025

Washington State Standard is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Washington State Standard maintains editorial independence. Contact Editor Bill Lucia for questions: info@washingtonstatestandard.com.