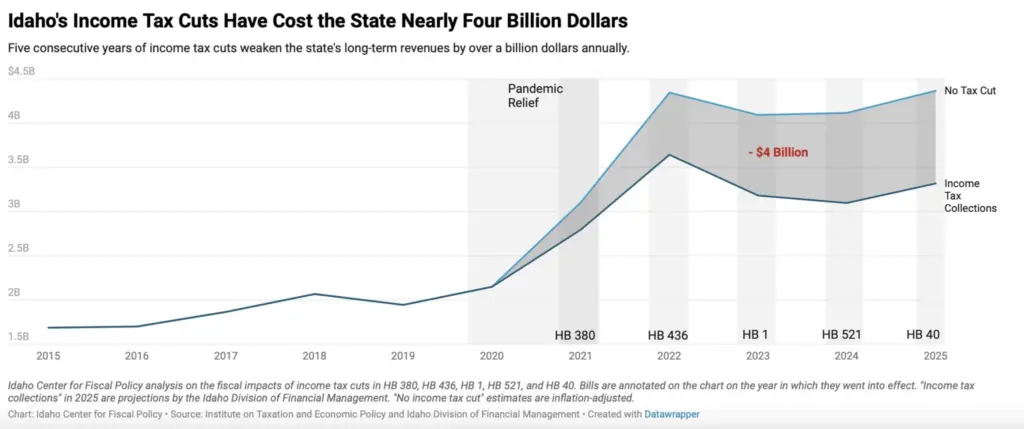

BOISE, ID – A new report issued this month by a nonpartisan, nonprofit organization shows the Idaho Legislature reduced state revenue by a combined $4 billion through a series of five income tax cuts passed since 2021.

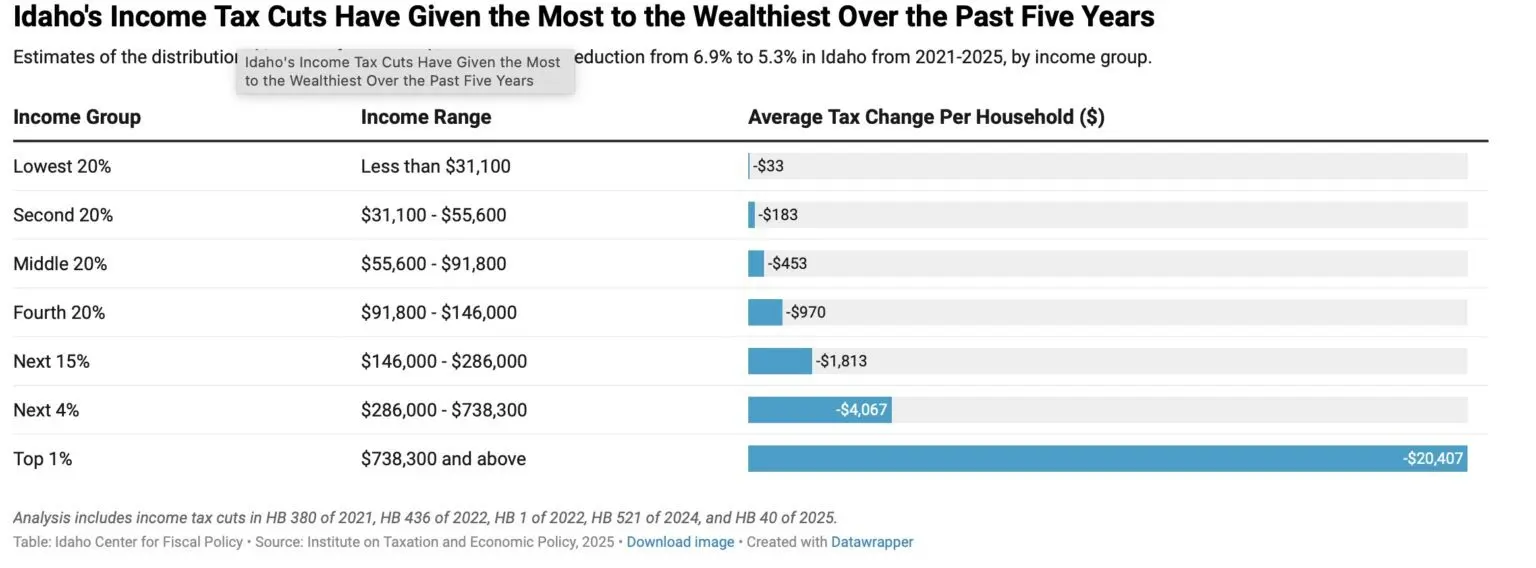

The new report also shows that wealthy Idahoans in the top 1% of earners – those with an annual income of $738,300 and above – benefited the most from the income tax cuts.

The report, “2025 Update: Idaho’s String of Income Tax Cuts Continues to Jeopardize Investments in Public Services,” was published by the Boise-based Idaho Center for Fiscal Policy.

“The report found that over the past five years since the income tax cuts started, those tax cuts cost the state almost $4 billion in lost revenue during that time,” Idaho Center for Fiscal Policy Policy Director Kendra Knighten said in an interview Friday. “Those are dollars that could have been invested in public education, or that could have gone into improving our roads and public safety. They could have gone into helping support Medicaid to help keep Idahoans healthy. Those are all dollars that the Legislature chose to provide tax relief with instead of investing in our communities, and that is something that we are really concerned about.”

“Beyond that, those are also dollars that we don’t have available to use to respond to in times during a recession,” Knighten said.

The report was issued just as the state of Idaho is grappling with 3% budget holdbacks, revenue shortfalls and a projected state budget deficit of $58.3 million for the current fiscal year 2026, the Idaho Capital Sun has previously reported.

In simple terms, revenue is the amount of money the state takes in. The largest sources of state general fund revenue are taxes – specifically the individual income tax, sales tax and corporate income tax.

This is important because the Idaho Constitution requires the Idaho Legislature to pass a balanced budget every year and prohibits the state from spending more in its budget than the state collects in revenue.

Cutting taxes has the effect of both reducing the amount of money Idahoans and companies pay in taxes, as well as reducing the amount of revenue available to the state.

Idaho income tax cuts benefited wealthy Idahoans, companies, report finds

The new Idaho Center for Fiscal Policy report found that the top 1% of earners making more than $738,300 per year received an average annual tax cut of $20,407 through the income tax cuts.

Meanwhile, the lowest 20% of earners – those with an annual income of less $31,100 – benefited the least from the income tax cuts. The lowest 20% of earners saw their incomes taxes cut by an average of $33 per year, according to the Idaho Center for Fiscal Policy report.

Officials with the policy center warn that reducing state revenue by such large amounts reduces the amount of money the state of Idaho has to invest in core public services like public schools, transportation, public safety and infrastructure.

May Roberts, a policy analyst for the Idaho Center for Fiscal Policy, said that if the state cuts budgets during times of economic hardship or uncertainty, it can be difficult to recover from those cuts.

Roberts published a report earlier this month that showed – when adjusted for inflation – Idaho’s per-pupil funding for public schools still lags behind funding levels reached prior to the 2001 recession. Funding levels have recovered from the 2008 recession, Roberts found, but still lag behind where they stood more than 20 years ago, once adjusted for inflation.

“Budget cuts that happen during times of economic hardship have long-lasting effects on the budget,” Roberts said Friday. “It can be difficult to bounce back and reach the level of investment we had in the past once those budgets are cut.”

Idaho House Speaker Moyle, conservative orgs say tax cuts benefit Idahoans

Each of the tax cuts tracked in the new report was supported or co-sponsored by House Speaker Mike Moyle, R-Star, the powerful, longest-serving and highest-ranking member of the Idaho House of Representatives.

Efforts to reach Moyle on Friday were unsuccessful.

But for years Moyle has led the charge to reduce income tax rates and championed the benefit of tax cuts.

“This is the people’s money, not ours in government,” Moyle said in a written statement issued in March following the passage of House Bill 40 in the Idaho Legislature. “Today, we are delivering the single largest income tax cut in state history, and we are just getting started. Giving back the people’s money has always been and will remain a top priority of mine as Speaker.”

On April 4, the day the 2025 legislative session adjourned, Moyle predicted the 2025 legislative session would be remembered for tax cuts.

“We have over $400 million in tax relief this year,” Moyle said in an April 4 press conference.

“We touched income tax. We touched property tax. We touched sales tax. We did a good job of adjusting all of those in a downward trend, which is good for the state of Idaho.”

The conservative Mountain States Policy Center has also championed tax cuts in Idaho.

“While we wait to see which taxes are reduced and by how much this year in Idaho, we should appreciate the good economic policies and fiscal discipline that make this debate possible,” Mountain States Policy Center officials wrote in a newsletter issued Jan. 9, during the first week of the 2025 legislative session. “The ‘Idaho Way’ of prioritizing tax relief leads to a much brighter economic future than the tax-and-spend mentality of our neighbors to the West.”

Idaho Gov. Brad Little, who signed the tax cuts into law, has vocalized both support for cutting taxes and concerns about reducing state revenues.

“Idaho families and businesses need and deserve to keep more of their hard earned money,” Little said in a written statement issued March 6. “It is the right thing to do. Idaho’s continued strength comes from our focus on good government and the Idaho taxpayer. I appreciate my partners in the Legislature for sharing our goal of prioritizing tax relief while taking care of the needs of a growing state. As we continue to deliver historic tax relief, we must ensure our budget balances as the Idaho Constitution requires.”

Efforts to reach Little for comment on Friday were unsuccessful. However, during a February breakfast with Idaho reporters, Little expressed concern about the Idaho Legislature reducing revenue by $450 million during the 2025 legislative session. The $450 million went to paying for new tax cuts and a new education tax credit that reimburses families for education expenses outside of the public school system, including tuition at private, religious schools.

“If I would have thought we could do $450 (million), I would have proposed $450 (million),” Little told reporters Feb. 25.

Which laws and tax cuts were analyzed for the new budget report?

For the new report, the Idaho Center for Fiscal Policy Center analyzed five years of tax cuts.

Those tax cut laws include:

- House Bill 380, 2021 legislative session: The law reduced all income tax brackets, reduced the number of tax brackets from seven to five and reduced the top corporate and income tax brackets to 6.5%

- House Bill 436, 2022 legislative session: The law reduced the number of tax brackets from five to four, reduced individual income tax rates, lowered the corporate income tax rate to 6% and provided a one-time tax rebate.

- House Bill 1, 2022 special legislative session: The law created a flat income tax system by reducing the number of tax brackets to one, reduced the corporate and income tax rates to 5.8%, provided a one-time tax rebate and provided funding taken from sales tax collections for the public school income fund.

- House Bill 521, 2024 legislative session: The law reduced the income tax rate from 5.8% to 5.695% and provided additional money from sales tax collections to funds for public schools.

- House Bill 40, 2025 legislative session: The law reduced the income tax rate from 5.695% to 5.3% and made other tax changes.

Idaho Capital Sun is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Idaho Capital Sun maintains editorial independence. Contact Editor Christina Lords for questions: info@idahocapitalsun.com.