BOISE, ID – As Gov. Brad Little weighs whether to sign a bill adopting many of the federal tax cuts approved in the One Big Beautiful Bill Act, the state tax commission is estimating that budget cuts — made to create room for the cost of tax conformity — may significantly delay refunds getting back to taxpayers.

Idahoans could wait months for their refunds, while the state would be on the hook for millions in interest payments due to the delays, according to a memo to lawmakers from the Idaho State Tax Commission.

The state budget writers on the Joint Finance-Appropriation Committee, or JFAC, last week approved a bill that would cut nearly every state agency budget by an additional 1%, totaling $131 million in state general funds, in the current fiscal year that ends June 30.

Ahead of the cuts, the co-chairs of JFAC asked agency heads to determine where they could make these reductions, which were in addition to the 3% cuts the governor required this summer to address a projected budget shortfall.

Idaho Tax Commission Chairman Jeff McCray wrote to the budget writers that most of its current year budget is already obligated. He said that reducing the commission’s tax season temporary workforce would be one of its few options.

“It will save $210,308, but will extend payment and refund processing by 12 to 18 weeks, resulting in interest payments from the General Fund,” the memo said.

Based on the amount the state refunded last year, the delays would result in an estimated minimum cost of $3.5 million from interest, McCray wrote.

The tax commission’s challenges may be compounded by a host of complicated changes within the tax conformity bill that’s now on Little’s desk. The Idaho Senate on Friday approved the bill, sending it to the governor for consideration.

The bill would apply to 2025 taxes. Little in his proposed budget suggested conforming to the tax changes starting in 2026.

Little’s budget chief, Division of Financial Management Administrator Lori Wolff, told reporters Tuesday that she’s aware the tax commission is very concerned about the timeline with the cuts.

“The tax commission is going to be faced with a very expedited time frame to be able to implement those cuts retroactively to tax year ‘25,” Wolff said. “There was no additional funding in the fiscal note to assist the tax commission in putting those additional changes in place, and with the reductions that were approved by JFAC for the additional 1%, the tax commission is very concerned that they will be able to process refunds and tax submissions timely. So we could see some significant delays this tax year.”

Each year, the Idaho Legislature must approve the annual tax conformity bill because the state uses the federal tax code as a template for state taxes. In a typical year, that change may simply include changing a date.

This year, House Bill 559 would adopt nearly all the 39 individual and corporate tax provisions from the federal Big Beautiful Bill approved in July, with an estimated $155 million reduction in state revenue this fiscal year.

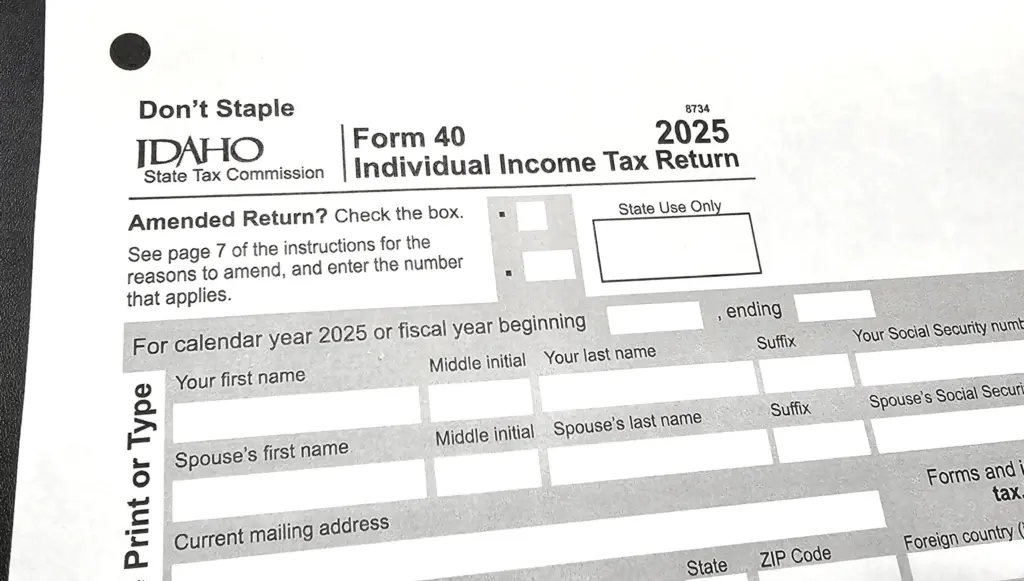

The tax commission in December — before additional budget cuts were approved by JFAC — wrote in a summary of the impact of the bill that conforming retroactively to Jan. 1, 2025, would mean it would need to immediately redesign forms, direct software vendor updates, and provide revised training for tax professions, according to a document obtained through a records request.

“This will also result in taxpayers having to file amended returns,” the document said.

HB 559 sponsor Rep. Jeff Ehlers, R-Meridian, has said that he and other legislative sponsors thought it was important to make the cuts retroactive, because the federal individual tax benefits in the Big Beautiful Bill only last four years. The corporate benefits are permanent.

Ehlers previously told the Idaho Capital Sun that he wasn’t concerned about the timing for the tax commission.

“We’ve made it happen in the past in a (significantly) reduced timeline,” Ehlers said. “We’ve done it every year, and we can do it again this year.”

This story first appeared on Idaho Capital Sun.