BOISE, ID – The Idaho Senate on Friday approved a bill to adopt nearly all the tax cuts from the federal One Big Beautiful Bill, at an estimated cost to the state of $155 million in the current fiscal year. The projected cost for the next fiscal year, which starts July 1, is $175 million.

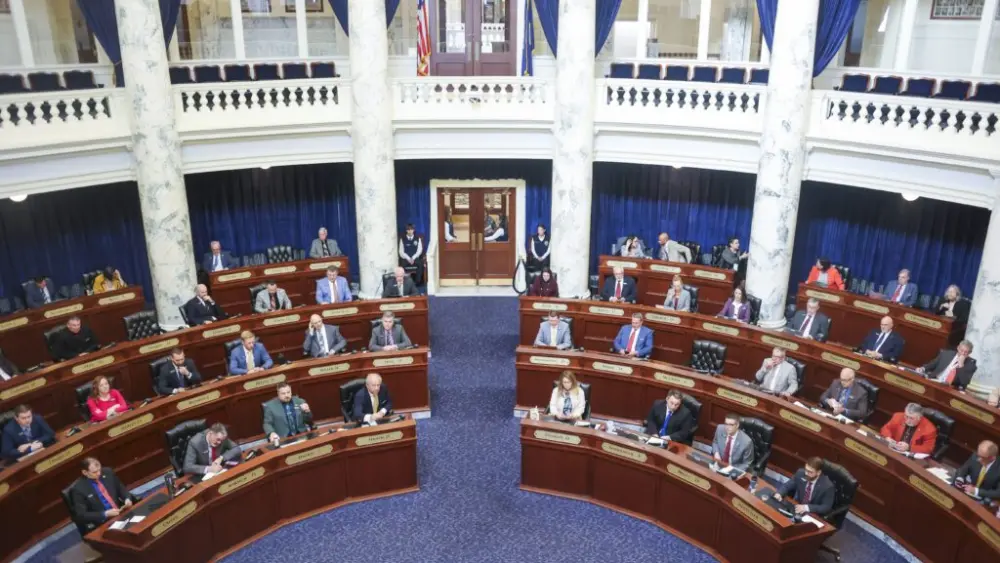

House Bill 559 passed in a nearly party-line vote, will go to Gov. Brad Little for consideration.

The decision took place shortly after the state budget committee approved permanent cuts on several agencies for the current and next fiscal year. The cuts were in addition to the 3% cuts that the governor called for in August and September.

Idaho Legislature’s budget committee approves additional budget cuts for most state agencies

The Legislature each year approves a tax conformity bill to align Idaho’s tax code to the federal code. With the several changes made in the massive federal bill approved in July, this year’s state conformity bill provoked concern from Idaho Democrats over the reductions being made to create room in the state’s already tight budget for the tax cuts.

The conformity bill would allow for taxpayers to take advantage of the same benefits from the federal policy, including no taxes on workers’ tips, no taxes on overtime, and an enhanced senior deduction for those in a certain income range, on their state income taxes. The individual benefits expire in 2028. There are also a number of corporate tax write-offs, which remain in effect in perpetuity.

Senate Majority Leader Lori Den Hartog, R-Meridian, expressed frustration that the federal bill put a sunset date on the tax deductions for individuals while keeping the corporate incentives permanent. She voted for the bill.

All Senate Democrats voted against the bill, with several speaking to the potential harms caused by the cuts to other programs that will be made to create room in the budget.

Senate Minority Leader Melissa Wintrow, D-Boise, argued that potential cuts to things like Medicaid services for people with disabilities, Meals on Wheels for seniors, and skilled nursing homes were not worth the tax cuts.

“I just think that’s wrong,” Wintrow said of the ongoing agency cuts. “We really need to rethink that. We need to be more conservative, and in that respect, restore the revenue that we’ve taken out and cut too hard. Because our government is on the brink, and folks are suffering.”

Sen. Jim Guthrie, R-McCammon, was the only Republican who voted against it, and did so because the bill did not fully conform to the Big Beautiful Bill’s research and experimentation deduction. The federal tax benefit is retroactive to 2022 expenses. However, the state bill instead allows the deduction to only be taken in full from 2025 and beyond, while allowing past expenses to be amortized, or deducted in smaller increments at a time.

Guthrie said that many businesses anticipated full conformity and withheld their expenses accordingly.

“In my opinion, we should rip the Band-Aid off now and fully conform,” he said.

A number of Republicans said that they would rather see tax cuts go to Idahoans than for the state to have the revenue.

“Even though there is a cost of $155 million projected for (fiscal year 2026), there is a huge benefit to our Idaho taxpayers,” said bill sponsor Sen. Doug Ricks, R-Rexburg.

Idaho Capital Sun is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Idaho Capital Sun maintains editorial independence. Contact Editor Christina Lords for questions: info@idahocapitalsun.com.